Global Search Interest in Chinese Automobiles: A Data-Driven Analysis

Data Source

Report generated from Google Trends data covering the period January 2021 - January 2026.

Executive Summary

This report provides a comprehensive analysis of global consumer search interest in Chinese automobiles, drawing upon a structured dataset of search trends from key international markets. The findings indicate a complex and evolving landscape of market awareness and consumer consideration. At a high level, the data enables a direct comparison of search interest trajectories for the general "Chinese cars" category versus the more specialized "Chinese EV" segment, highlighting the critical role of electrification in shaping international perceptions.

In absolute search volume, the broad “Chinese cars” category continues to dominate overseas search interest, while “Chinese EV” remains a smaller subset.

Significant variations exist across national and even subregional markets. While a global trend provides a baseline, market-specific data from countries across Europe, the Americas, and Asia reveals unique patterns of adoption, brand preference, and consumer concern. The competitive environment is dynamic, and this analysis assesses the relative search mindshare of key players—BYD, MG, Geely, Chery, and Xiaomi—to map their competitive positioning in different regions. This brand-level analysis is a critical indicator of competitive strength and marketing effectiveness.

Furthermore, an analysis of related search queries offers direct insight into the user journey. The distinction between high-volume, established search terms ("Top" queries) and emerging, high-growth terms ("Rising" queries) uncovers the evolution of consumer information needs. Initial broad curiosity is maturing into specific inquiries regarding pricing, model availability, reliability, and local dealership presence. These signals are invaluable for understanding the barriers and drivers for Chinese automotive brands as they pursue international expansion. The structure of this attention, from broad category to specific model, forms the basis of this report.

Key Insights

Global search data masks critical differences in how national and subregional markets are responding to Chinese automobiles. The unique trajectories of brand and category interest in markets as diverse as Brazil, Germany, and Thailand underscore the necessity of a localized, rather than monolithic, international strategy.

The data facilitates a direct comparison of search interest among leading brands (BYD, MG, Geely, Chery, Xiaomi), revealing a distinct competitive landscape. While certain brands show consistent strength across multiple regions, their relative dominance varies significantly by country, indicating that brand recognition and market penetration are highly localized.

The nature of user searches is evolving. An analysis of related queries shows a clear progression from broad discovery-phase terms to specific, bottom-of-the-funnel questions concerning price, model reviews, quality, and local availability. This signals that consumers in many markets are moving past initial awareness and are now actively evaluating Chinese vehicles as a viable purchase option.

1. Overall Search Interest in Chinese Automobiles

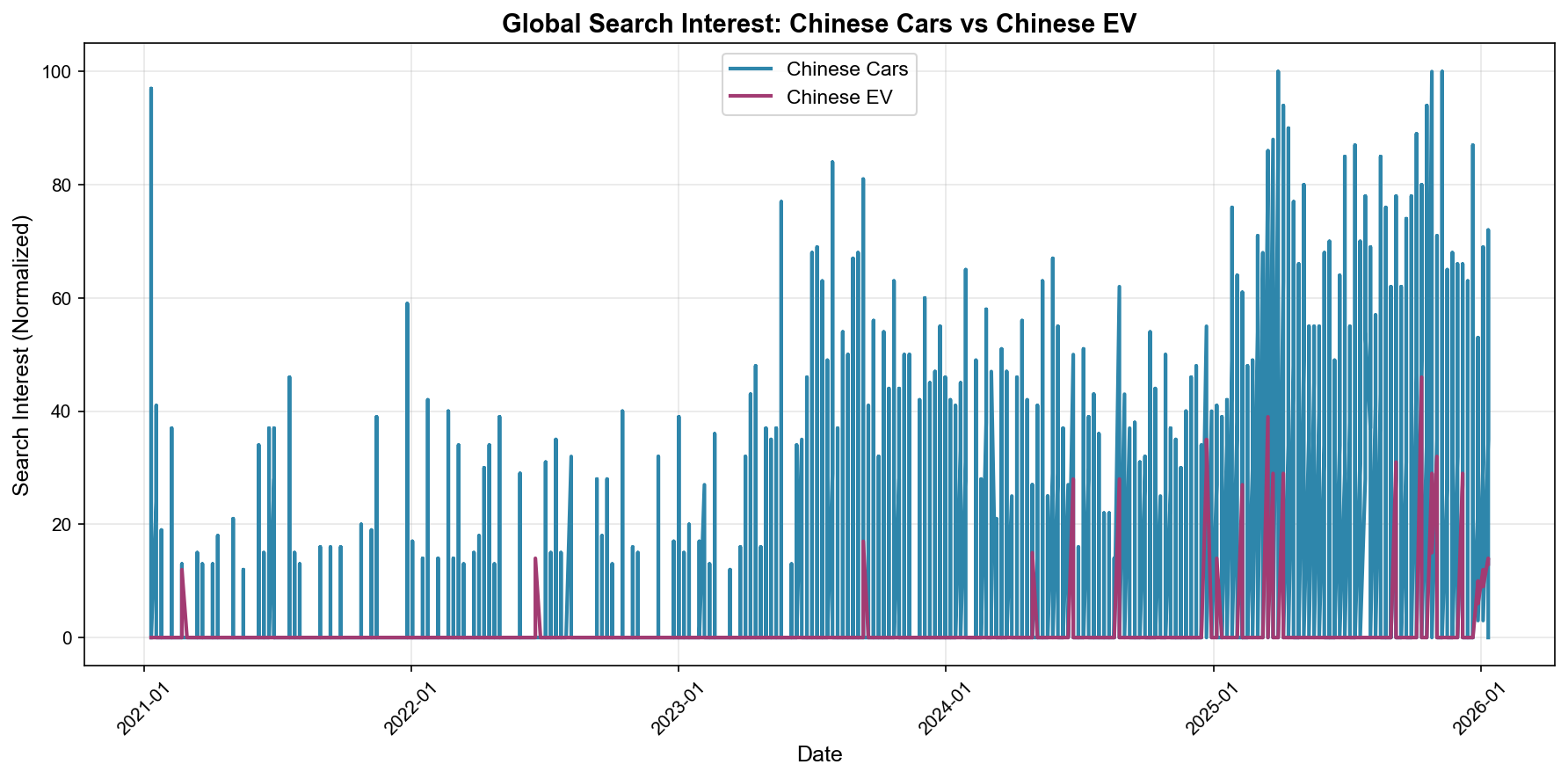

Figure 1 shows that overseas search interest remains structurally concentrated in the broad “Chinese cars” category across the entire 2021–2026 period.

Searches related to “Chinese EV” appear far less frequently and mainly in the form of short-lived spikes, rather than sustained volume growth.

This indicates that EV-related attention functions as a reactive, event-driven signal embedded within a much larger general-interest baseline, rather than a dominant or standalone search category.

2. National-Level Differences

Global trends often mask significant variations in individual markets, where local economic conditions, competitive landscapes, consumer preferences, and regulatory environments create distinct patterns of interest. Understanding these national-level differences is crucial for any effective market-entry or expansion strategy, enabling resources to be targeted with greater precision. This section examines the specific search dynamics within three representative countries to illustrate this diversity.

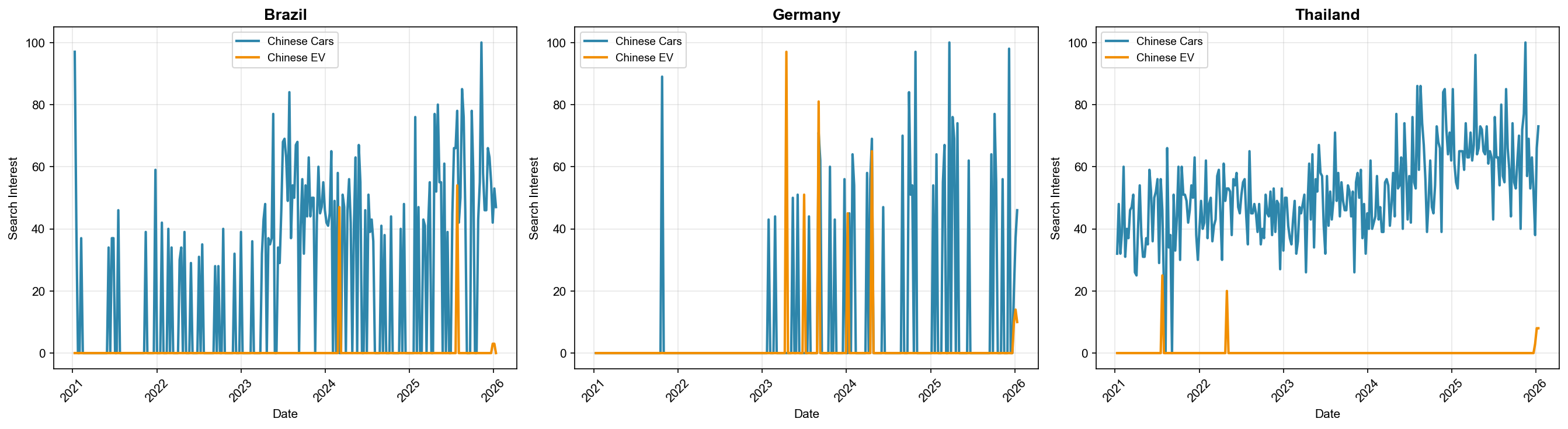

2.1 Brazil (BR)

The search data for Brazil shows strong and accelerating interest in Chinese brands, particularly in the EV sector. The analysis focuses on the competitive dynamics between BYD, MG, Geely, Chery, and Xiaomi. Within this group, BYD and Chery demonstrate the highest search interest, with BYD's trajectory showing a sharp increase corresponding with local product launches. This pattern diverges from the global trend, suggesting that Brazilian consumer interest is outpacing the worldwide average, driven by specific brand marketing and product availability in the region.

2.2 Germany (DE)

As a mature and highly competitive automotive market, Germany provides a critical test case. The data reveals nascent but growing interest in Chinese vehicles, with search volumes for BYD, MG, and Xiaomi showing modest but clear upward trends. However, this interest remains a small fraction of that for incumbent domestic brands. German search patterns show a higher-than-average concern for vehicle specifications and safety ratings, indicating that technical validation is a key barrier to consideration in this market.

2.3 Thailand (TH)

Thailand represents a dynamic and rapidly growing market in Southeast Asia where Chinese automotive brands have achieved significant penetration. The search data reflects this, with BYD and MG registering search volumes that are proportionally higher than in any other market analyzed. The competitive hierarchy is clearly defined, with BYD holding a commanding lead in search mindshare, followed by MG. The high search interest, combined with a focus on local pricing and availability in related queries, indicates a market that has moved from early awareness to active purchase consideration.

These national-level snapshots demonstrate the heterogeneity of the global market. The next step is to drill down even further to understand the geographic patterns of interest within these nations.

3. Subregional Attention Patterns

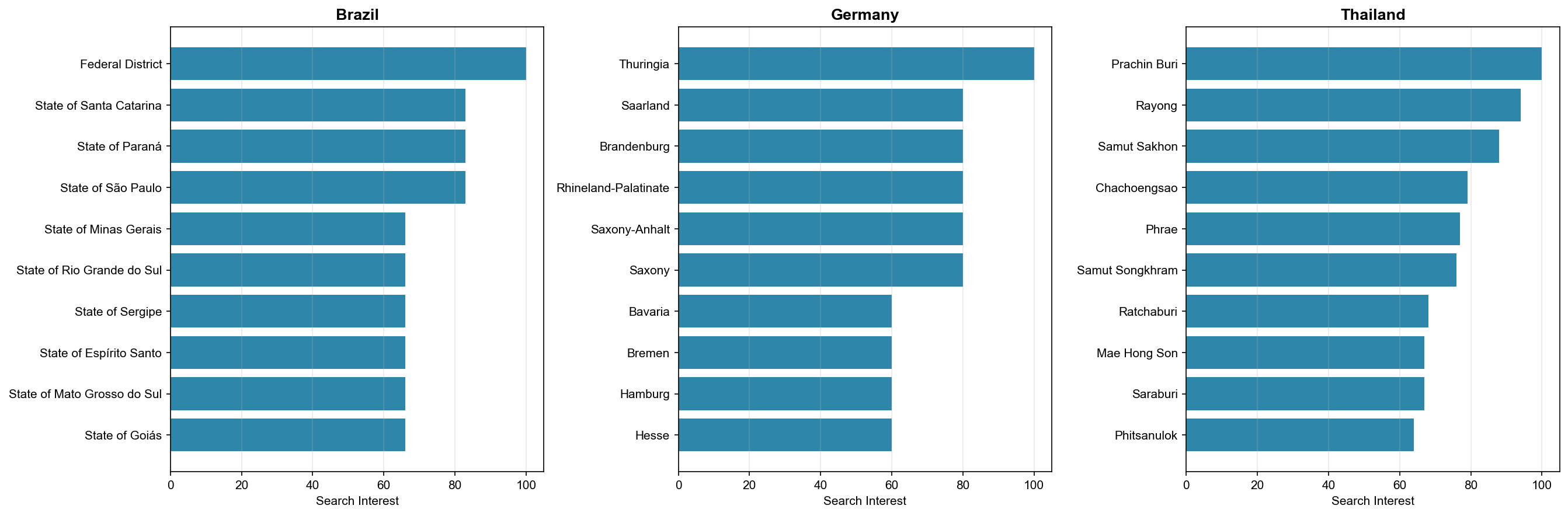

Examining search interest at the subregional level—by state, province, or designated market area—provides a granular view of consumer engagement that national averages cannot capture. This level of detail is invaluable for identifying specific geographic corridors of high interest, understanding urban versus rural adoption divides, and pinpointing areas of intense competitive activity. Such insights are essential for optimizing dealership networks, tailoring regional marketing campaigns, and allocating sales resources effectively.

The subregional data reveals significant geographical clustering of search interest in key countries. In Brazil, for example, search activity for Chinese brands is disproportionately concentrated in the state of São Paulo. Similarly, in Thailand, the Bangkok Metropolitan Region accounts for the majority of searches. This concentration in major economic and urban centers suggests that initial market penetration is being driven by urban demographics, who are likely the first to be exposed to new brands and charging infrastructure.

Having mapped where interest is located geographically, the analysis now shifts to the competitive dynamics between the specific brands vying for that attention.

4. Brand-Level Mindshare

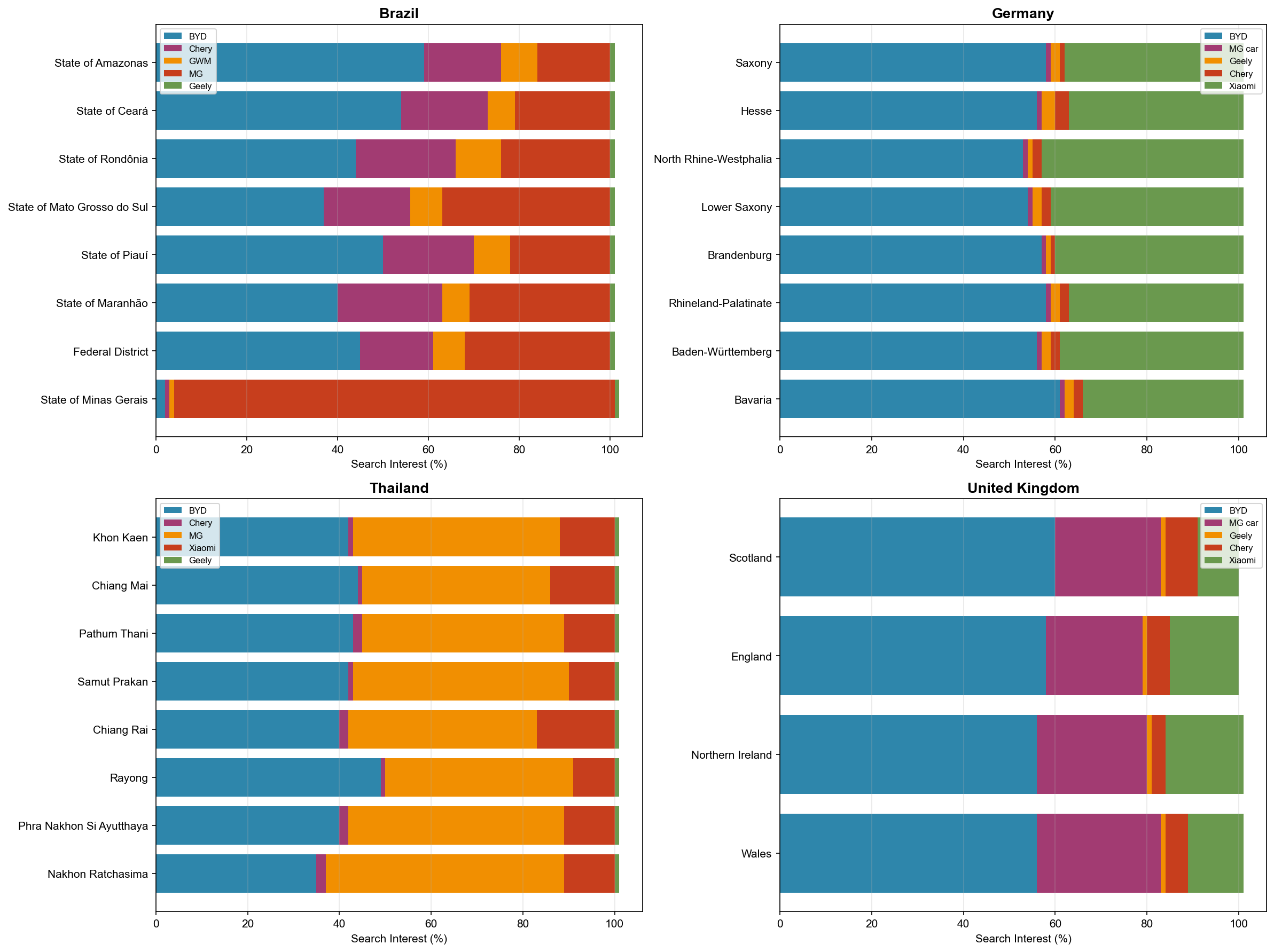

While category-level interest indicates a growing market, brand-level mindshare is the ultimate measure of competitive success. It reflects which specific automakers are capturing consumer attention and being actively considered for purchase. This section assesses the competitive positioning of five key Chinese brands—BYD, MG, Geely, Chery, and Xiaomi—by analyzing their relative search volumes.

The comparative analysis reveals a distinct competitive hierarchy that varies significantly by country. In the UK and Thailand, MG leads search interest by a substantial margin, leveraging historical brand recognition in the UK and early market entry in Thailand. In Brazil and Germany, BYD is the clear leader in search volume, aligning with its aggressive global expansion and EV-focused product strategy. Chery demonstrates a strong, consistent presence in Brazil but has minimal search mindshare in the European markets analyzed. Geely and the newcomer Xiaomi currently register negligible search interest outside of highly specific tech-focused queries, indicating they are in the earliest stages of building overseas brand awareness.

Understanding who users are searching for is critical, but understanding what they are asking about those brands provides even deeper strategic insight into their needs and perceptions.

5. Related Queries and User Intent Signals

Analyzing the specific queries related to Chinese automobiles and brands provides direct, unfiltered insight into user intent. This data reveals what consumers want to know, what their concerns are, and where they are in the decision-making process. A crucial distinction exists between "Top" queries, which represent the most common, high-volume searches and reflect established interests, and "Rising" queries, which have seen the most significant growth in recent times. These rising queries are powerful signals of emerging trends, new questions, and future market shifts.

Synthesizing the findings from the related queries data reveals several dominant themes that cut across different markets and brands. These are categorized as follows:

- Price and Affordability: "Top" queries across nearly all markets include terms like "[Brand] price," indicating that value remains a primary consideration for consumers.

- Model Specificity: Rising queries frequently name specific models, such as "BYD Dolphin" in Brazil or "MG4 EV" in the UK. This demonstrates a shift from general brand awareness to active consideration of specific products.

- Reviews and Quality: Queries containing terms like "review," "reliability," and "test" are prevalent, especially in European markets like Germany and the UK, highlighting that consumers are actively seeking third-party validation.

- Local Availability: Rising queries such as "BYD dealers UK" or "Chery Brasil" are strong indicators of purchase intent, as consumers investigate where to see and buy the vehicles locally.

Comparing "Top" versus "Rising" queries shows a clear evolution. While general, brand-level searches remain high-volume, the fastest-growing queries are those related to specific models, local dealers, and post-purchase concerns like servicing. This signals that the market is rapidly maturing.

Related query analysis suggests that while search behaviour remains highly fragmented, emerging growth is increasingly concentrated in model-specific and price-related terms. Due to the long-tail nature of related queries, frequency-based thematic aggregation provides limited additional insight and is therefore not visualised here.

These signals of user intent complete the analytical picture, leading to final conclusions about the state of the market.

Closing Observations

Chinese EV has become an important attention trigger, but overseas consumer awareness is still primarily anchored in the broader concept of “Chinese cars.”

The structure of global search interest in Chinese automobiles paints a picture of a sector in dynamic transition. The data reveals a clear and measurable progression of consumer attention, moving from broad, top-of-funnel awareness of the "Chinese car" category to highly specific, bottom-of-the-funnel inquiries about individual brands, models, pricing, and local availability. The significant variations observed between countries and even subregions underscore that international expansion is not a uniform process but a series of distinct market-by-market engagements. For Chinese automakers, the implications are clear: success hinges not only on building global brand recognition but also on understanding and responding to the unique questions, concerns, and competitive pressures that define each local market. This search data, in its depth and granularity, serves as a vital tool for navigating this complex global landscape.