The Era of 'Stagformation': Navigating Stagnation and Transformation in the Global Automotive Supplier Industry

The Era of 'Stagformation': Navigating Stagnation, Transformation, and Fragmentation in the Global Automotive Industry

Introduction: The Dual Challenge of Stagformation

The global automotive industry has entered a critical and paradoxical phase defined by "stagformation"—a confluence of stagnating volume growth and the urgent, capital-intensive need for structural transformation. Unlike previous cyclical downturns, today’s market landscape is marked by geopolitical uncertainty, shifting centers of gravity, and mounting cost pressures from prolonged technological transitions.

While other industrial sectors have enjoyed robust post-pandemic rebounds, the automotive supply base faces a unique structural crisis. It is trapped between the need to invest in a revolutionized future—defined by electrification and software—and the reality of a present characterized by flat volumes, overcapacity, and eroding margins. This environment demands a fundamental rethinking of business models, as the era of predictable, rising-tide growth has definitively ended.

The Financial Reality: Margins Under Siege

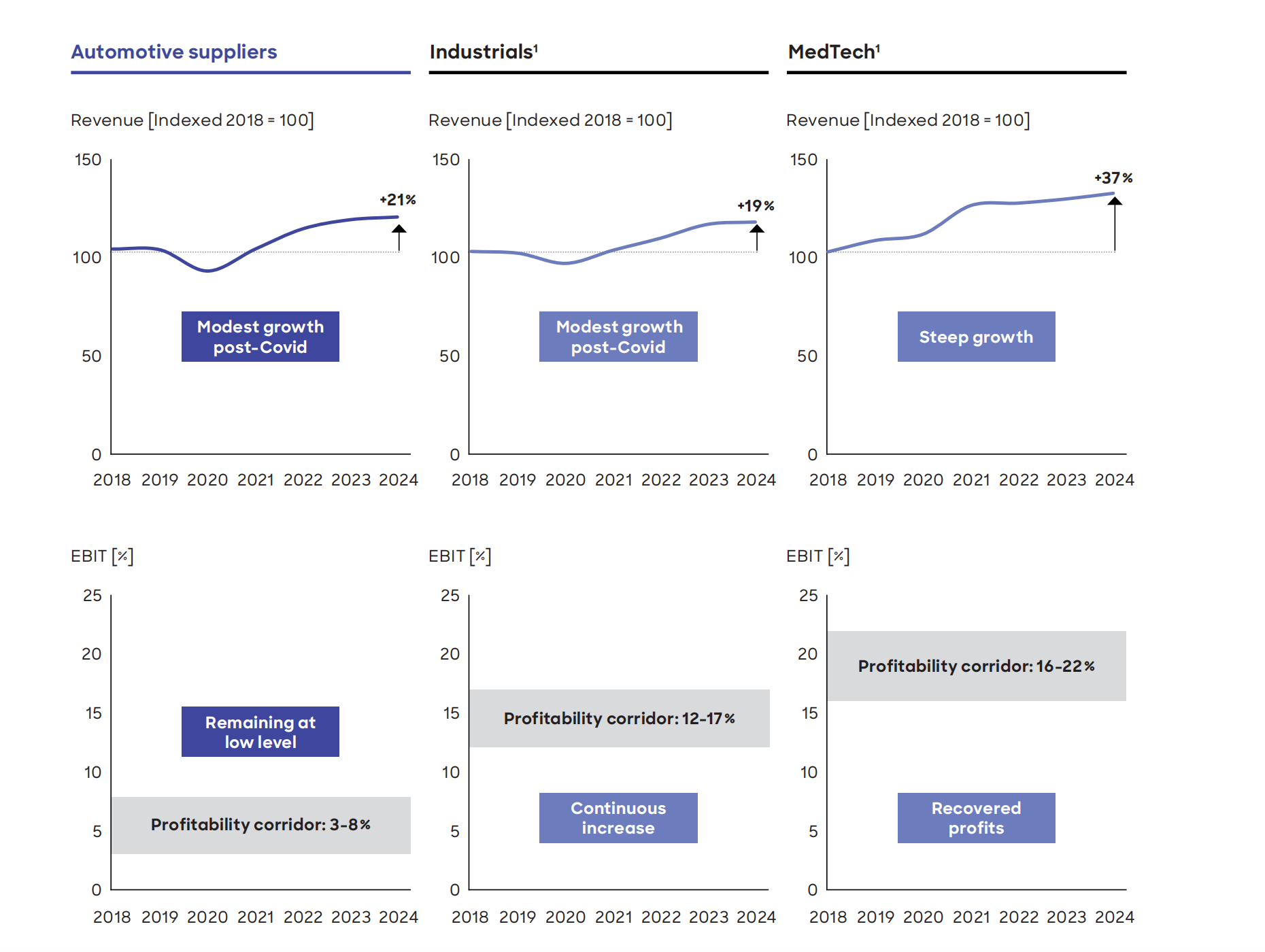

The financial toll of stagformation is stark. Following a brief period of stabilization in 2023, the profitability of the global supplier industry is deteriorating. EBIT margins are forecast to drop to 4.7% in 2024, remaining approximately two percentage points below pre-pandemic (2016–2017) levels. This represents a staggering 25% absolute decline in margin performance.

This underperformance is even more glaring when benchmarked against adjacent industries:

Semiconductor manufacturers report average EBIT margins of 21.6%.

Software companies achieve 35.5%.

MedTech and General Industrials have successfully rebounded, capitalizing on stable pricing, infrastructure spending, and high-value regulated products.

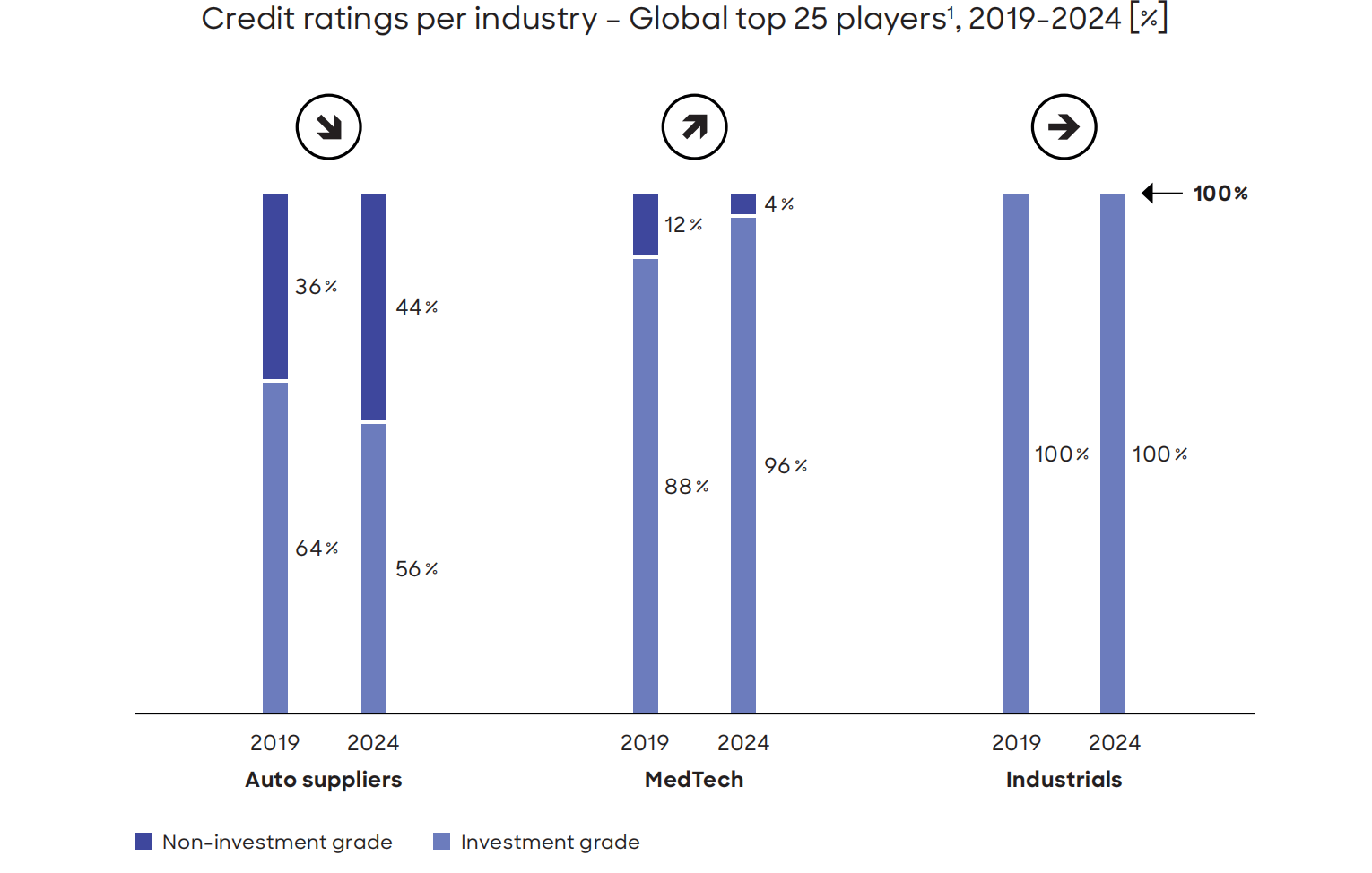

In contrast, automotive suppliers are squeezed by inflation-driven personnel and material costs, intensifying price pressure from OEMs, and the inability to fully pass on costs. The credit markets reflect this stress: over 40% of the top 25 automotive suppliers are now rated non-investment grade, compared to less than 5% in the MedTech and industrial sectors. This credit downgrade elevates refinancing costs precisely when investment in Battery Electric Vehicles (BEVs) and Software-Defined Vehicles (SDVs) is most critical.

A Tale of Two Worlds: Regional Divergence and Overcapacity

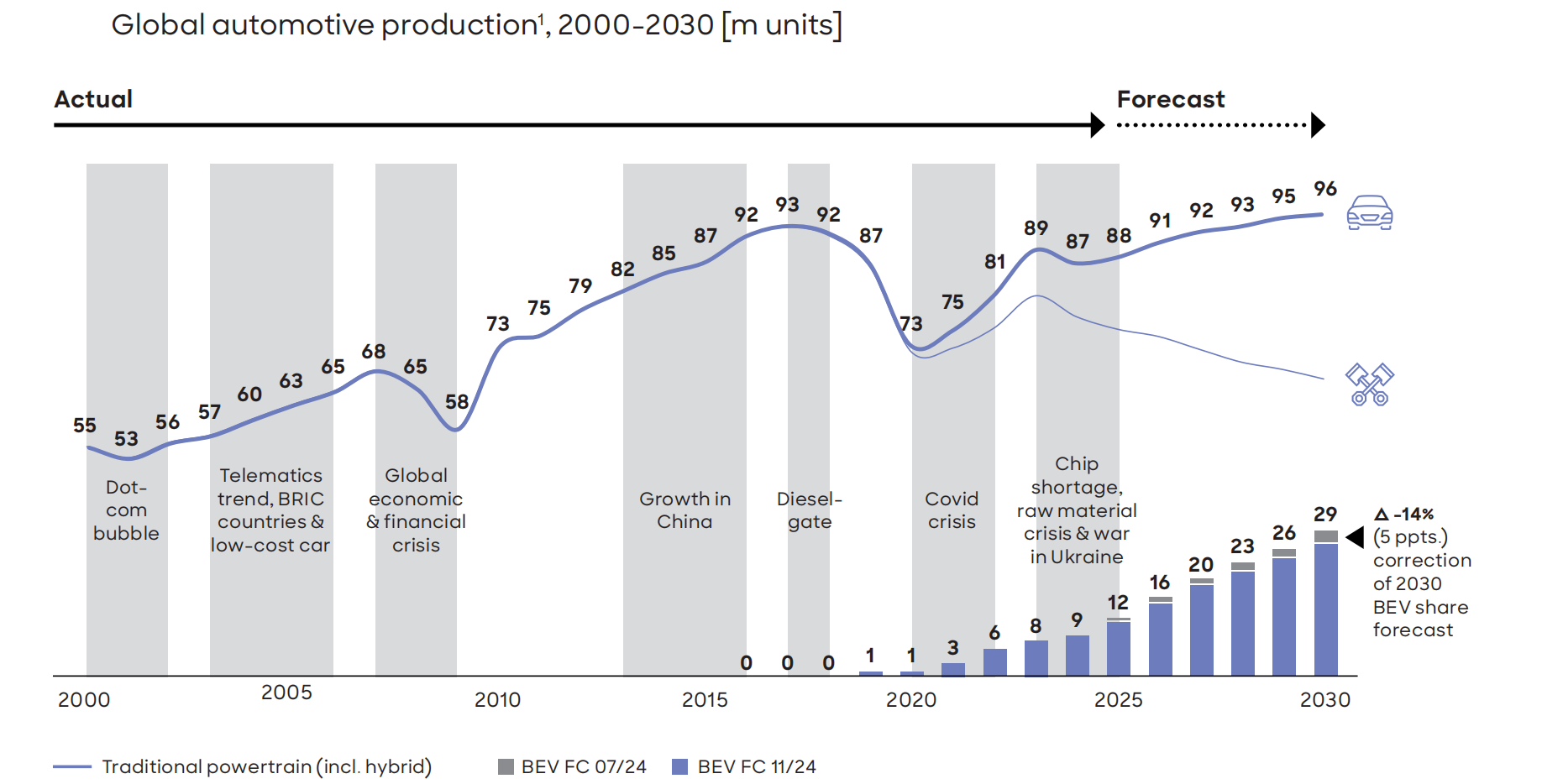

The recovery of global vehicle production is heavily skewed, creating a "two-speed" world. While global output is projected to reach just over 96 million units by 2030, this growth is driven almost entirely by China and the Global South.

China is expected to increase annual output from 29 million to 33 million units by 2030.

Europe and North America, conversely, face long-term stagnation. European production is forecast to flatline at 16–17 million units (below the 19 million pre-Covid peak), while North America will hover around 15–16 million units.

This regional imbalance has created massive structural inefficiencies. Between 2020 and 2030, the industry is projected to generate a cumulative production overcapacity of over 100 million units. Western markets bear the brunt of this excess, forcing suppliers into fierce competition for shrinking volumes in traditional strongholds, while trying to capture growth in increasingly inaccessible Asian markets.

The Scale Trap: Electrification and Shortening Lifecycles

Compounding the volume problem is the "scale trap" of the electric transition. The adoption of BEVs is decelerating, with the 2030 global market share forecast revised downward by 12 percentage points to 41%. Reasons include the withdrawal of subsidies in the EU and US, consumer hesitation due to high costs, and inadequate charging infrastructure.

However, even as adoption slows, the complexity costs remain. To compete, OEMs are accelerating product cycles and expanding portfolios, which dilutes economies of scale:

Declining Lifecycle Volumes: The average production volume for the global top 10 best-selling vehicles is projected to drop from 5.4 million units (2018) to 4.4 million by 2027.

The BEV Disadvantage: BEV lifecycle volumes are approximately 2.5 times lower than their Internal Combustion Engine (ICE) counterparts. For instance, the Volkswagen ID.3 achieves peak annual production of roughly 355,000 units, compared to 1.06 million for the ICE Golf VII.

With BEV powertrain costs remaining significantly higher than ICE equivalents (€11,400 vs. €4,700 for a C-segment car), suppliers are forced to deliver more advanced content at lower volumes, trapping them in a cycle of high investment and low return.

The Rise of China and Geopolitical Fragmentation

The competitive landscape is being reshaped by the aggressive rise of Chinese OEMs, who are expected to capture 71% of their domestic market by 2030 (up from 58% in 2023). Their advantage is structural:

Cost Leadership: Chinese OEMs boast 20%+ lower battery and e-drive costs.

Speed: Development cycles in China average 24–30 months, compared to 42–63 months in Europe and Japan.

This dominance is spilling over borders, shifting Europe from a net exporter to an import-dependent market for EVs. In response, geopolitics is rapidly fragmenting the global supply chain. The EU has imposed tariffs of up to 35.3% on Chinese EVs, and the US is moving to restrict Chinese software and hardware in connected vehicles. This "bifurcation" forces suppliers to maintain separate, parallel supply ecosystems for Western and Chinese markets, further eroding efficiency.

Strategic Imperatives for Survival

To navigate the era of stagformation, suppliers must abandon the expectation of a return to "normal" and pursue active transformation strategies:

1. Radical Portfolio Optimization

Suppliers must ruthlessly exit non-core, commoditized segments. Resources should be concentrated on defensible, high-value technologies such as ADAS, specialized electrification components, and software. Mergers and acquisitions (M&A) should be used not just for growth, but to consolidate fragmented markets and achieve necessary scale.

2. "Local-for-Local" Regional Strategies

The global "one-size-fits-all" strategy is obsolete. Suppliers need distinct approaches for each region:

In the West: Focus on restructuring, footprint rationalization, and cost-cutting to manage stagnation.

In China: Deepen localization and forge partnerships with winning local OEMs (e.g., BYD, whose automotive revenue skyrocketed from €8bn in 2019 to €63bn in 2023) to secure market access.

3. Operational Excellence and Standardization

To counter inflation and lower volumes, suppliers must drive cost leadership through:

Automation and AI: implementing digital process optimization to reduce personnel dependency.

Standardization: Pushing for industry-wide standards in hardware and software to reduce R&D complexity.

Monetizing Legacy: Maximizing cash flow from remaining ICE businesses to fund the transition to BEV and SDV technologies.

截屏2026-02-04 14.47.02

Conclusion

The automotive supplier industry is standing on unstable ground. The convergence of stagnant Western volumes, the rise of the Global South, decelerating electrification, and geopolitical friction has created a perfect storm. "Stagformation" is not merely a temporary dip but a structural reality.

Success in this environment requires agility and decisiveness. Suppliers that can optimize their portfolios, embrace a decentralized regional strategy, and align themselves with the industry's new winners will not only survive the stagnation but emerge stronger in the transformed automotive future.